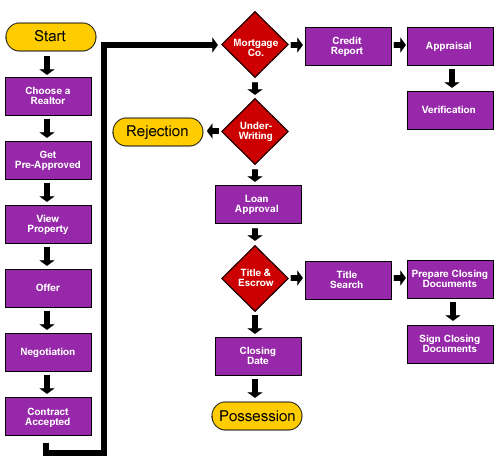

Buying a Home

For Buyers

Choose a Realtor

Your home is probably the biggest purchase your family will ever make, and it involves many decisions that go beyond simply choosing one you like. As Salem's leading group of Real Estate Professionals, we will help guide you through the entire home buying process, from viewing homes and financing, to making sure the final contract is in your best interest.

Get Pre-Approved

It's crucial that you obtain pre-approval for financing (unless you're in the enviable position of being able to pay cash). Having a letter of pre-approval that can accompany your offer strengthens your position greatly. There are many qualified lending institutions that will help you determine the kind of mortgage loan that will best fit your needs and provide you with a good faith estimate, which is an itemized list of estimated fees and costs associated with your loan. This will also help you in your decision on whether or not "now" is the right time to buy. Choosing the right lender is important. We're happy to provide great recommendations if you don't already have one in mind.

View Property

This is the most exciting part of the home buying process for most people. That's why it is vitally important to have a REALTOR working on your behalf. The professionals at Blum Real Estate are here for you. We have access to every home listed in the Multiple Listing. Our knowledge of this market and our diligence in matching buyers with the "right" home is what makes Blum Real Estate one of the leaders in our industry.

Offer

Once we have helped you find that perfect home, it's time to make an offer! The professionals at Blum Real Estate are here to help you make an informed decision by making you aware of similar recent home sales and other similar listings currently on the market. Putting this information together, combined with our overall knowledge of this market, will help you determine (and support) your offer amount. Your offer will also likely include contingencies such as financing and inspections. You will also need to submit a deposit to show that you are earnest about your desire to buy - appropriately called "earnest money".

Negotiation

Your Blum Real Estate professional will prepare a purchase contract according to your instructions and will take the offer to the listing REALTOR. At that time we will negotiate on your behalf as to why we believe the seller should consider the terms of your offer. Your interests will always be our top priority!

Contract Accepted

Upon receipt of your offer, the seller may accept it as written, or make "counter offers" on unacceptable aspects, or reject it. Your Blum Real Estate professional will then bring back the offer to you, at which time you can accept it, counter-the-counter offer, or reject it. The offer to purchase becomes a contract when all parties have initialed every counter, signed the offer and received notice.

Mortgage Company

Now that you have identified the property that you would like to purchase and have an accepted contract, the lender (assuming that you will be obtaining financing) will now begin the process of working on your behalf toward loan approval for the purchase of this specific property. Your Blum Real Estate Professional will work closely with the lender to help facilitate deadlines and documentation. Choosing the right lending institution is of the utmost importance. Most lenders are fairly competitive, so finding a loan officer that relates well with you and provides great service becomes a key factor. If you don't have a lender that you have in mind, we would be glad to offer some great recommendations.

Credit Report

This is a report that the lender will order which details an individual's credit history. This is used by a lender in determining a loan applicant's creditworthiness.

Appraisal

In short, an appraisal is a service performed by an appraiser to determine market value of the property (what the property is worth). As part of the loan process, the lender will need an appraisal on the property to determine if the loan amount being requested will be adequately secured by the property.

Verification

The process whereby the lender will request information and documentation to prove your income and employment. These documents are important for the lender in order to help determine how much house you can afford. Often times a lender will ask for an employment letter, any documentation of additional income, copies of statements from your financial institutions, and the last two years of tax returns.

Underwriting

This is the final step prior to loan approval. The underwriter will review all the information that the loan officer has gathered to determine if the risk of offering a loan to a particular borrower is acceptable.

Rejection

The loan is rejected in underwriting.

Loan Approval

The loan is approved in underwriting.

Title & Escrow

This is the third party company that examines the title thoroughly to validate its authenticity, and also tries to delve out all the legal and financial issues related to the property. Furthermore, it facilitates the closing of the real estate deal!

Title Search

The primary responsibility of the Title company tackling issues related to the title is to search for the Title Deed to ascertain whether the seller is the true owner of the property or not. Apart from the ownership details, the company also looks for possession details. False claims can adversely affect the deal; for this reason, Title research is crucial.

Prepare Closing Documents

The closing agent reviews the loan papers for consistency and accuracy prior to closing. A closing statement is also prepared to reflect any charges and disbursements involved in the transaction. Most importantly, the closing agent prepares the deed which transfers the title of the property from the seller to the buyer, as well as any other legal papers which are necessary to complete the transaction.

Sign Closing Documents

The day in which the buyer(s) meet with the closing agent as they are guided through the settlement process, accounting for each credit and charge on the closing statement, and explaining the papers which the buyer will be signing.

Closing Date

This is the exciting day when the property that you fell in love with officially becomes yours! The title company records the deed and deed of trust in the public land records; funds are disbursed; the liens (old mortgages) on the property are paid off and released from the land records so that they do not show up as liens on your property.

Possession

The date negotiated in the purchase agreement that the buyer is allowed to take possession of the property.

(click on each of the steps for more detail)

Chart © 2015 Troy Blum