Blog

How Today’s Mortgage Rates Impact Your Home Purchase

If you’re planning to buy a home, it’s critical to understand the relationship between mortgage rates and your purchasing power.

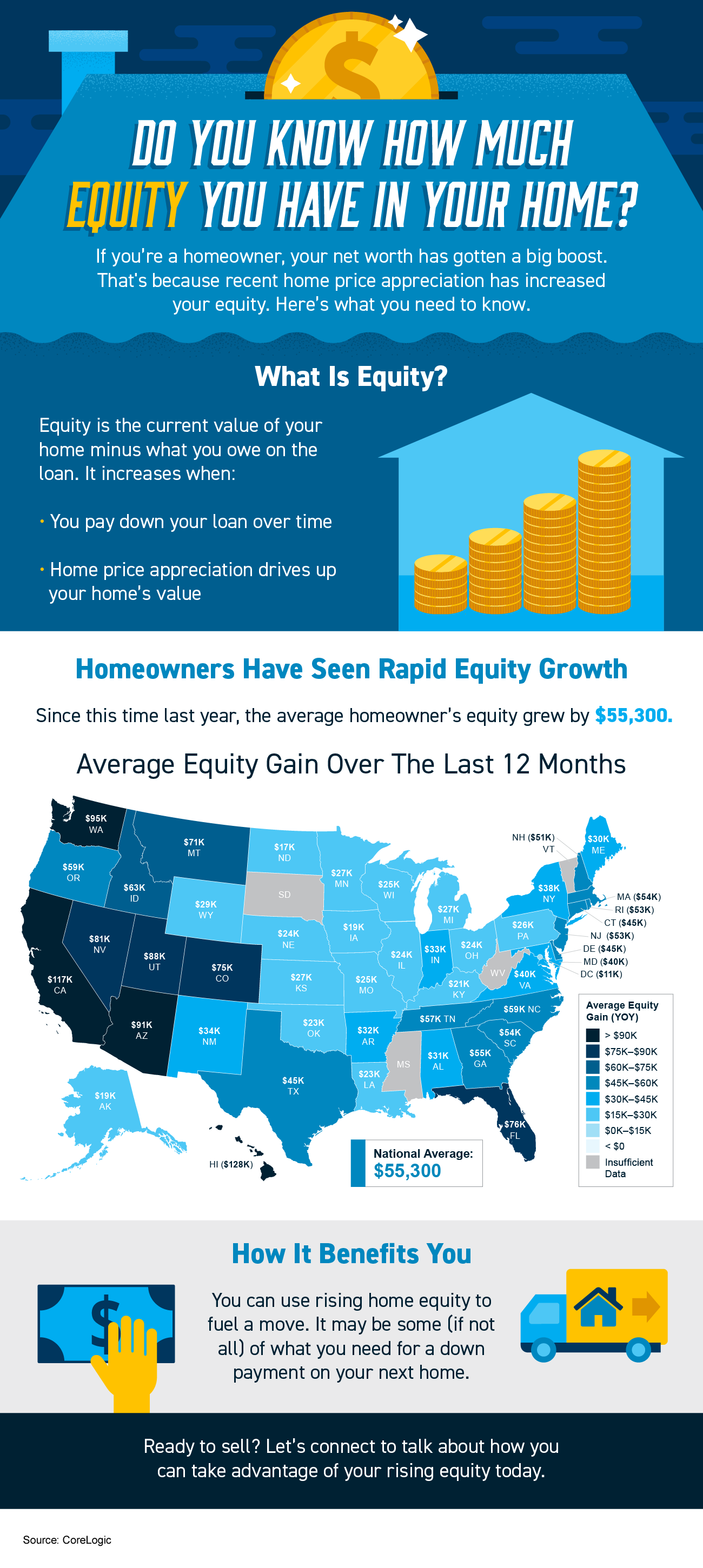

Do You Know How Much Equity You Have in Your Home? [INFOGRAPHIC]

Do you know how much equity you have in your home?

Key Factors That Impact Affordability Today

You can’t read an article about residential real estate without the author mentioning the affordability challenges that today’s buyers face. There’s no doubt homes are less affordable today than they were over the last two years, but that doesn’t mean homes are now unaffordable.

The Path To Homeownership Can Be Steeper for Some Americans

As we celebrate Black History Month, we honor and recognize the past and present experiences of Black Americans. A significant part of this experience is investing in a home of their own. While equitable access to housing has come a long way, the path to homeownership is still steeper for households of color. It’s an important experience to talk about, along with how working with the right real estate experts can make all the difference for diverse homebuyers.

Real Estate Professionals Are Experts at Keeping You Safe When You Sell

If you’re on the fence about whether or not you want to sell your house this year, there’s good news. For nearly two years, real estate professionals have worked tirelessly to ensure the safety of buyers and sellers during the pandemic.

Two Reasons Why Waiting To Buy a Home Will Cost You

If you’re a homeowner who’s decided your current house no longer fits your needs, or a renter with a strong desire to become a homeowner, you may be hoping that waiting until next year could mean better market conditions to purchase a home.

How Sellers Win When Housing Inventory Is Low

In today’s housing market, the number of homes for sale is much lower than the strong buyer demand. As a result, homeowners ready to sell have a significant advantage. Here are three ways today’s low inventory will set you up for a win when you sell this season.

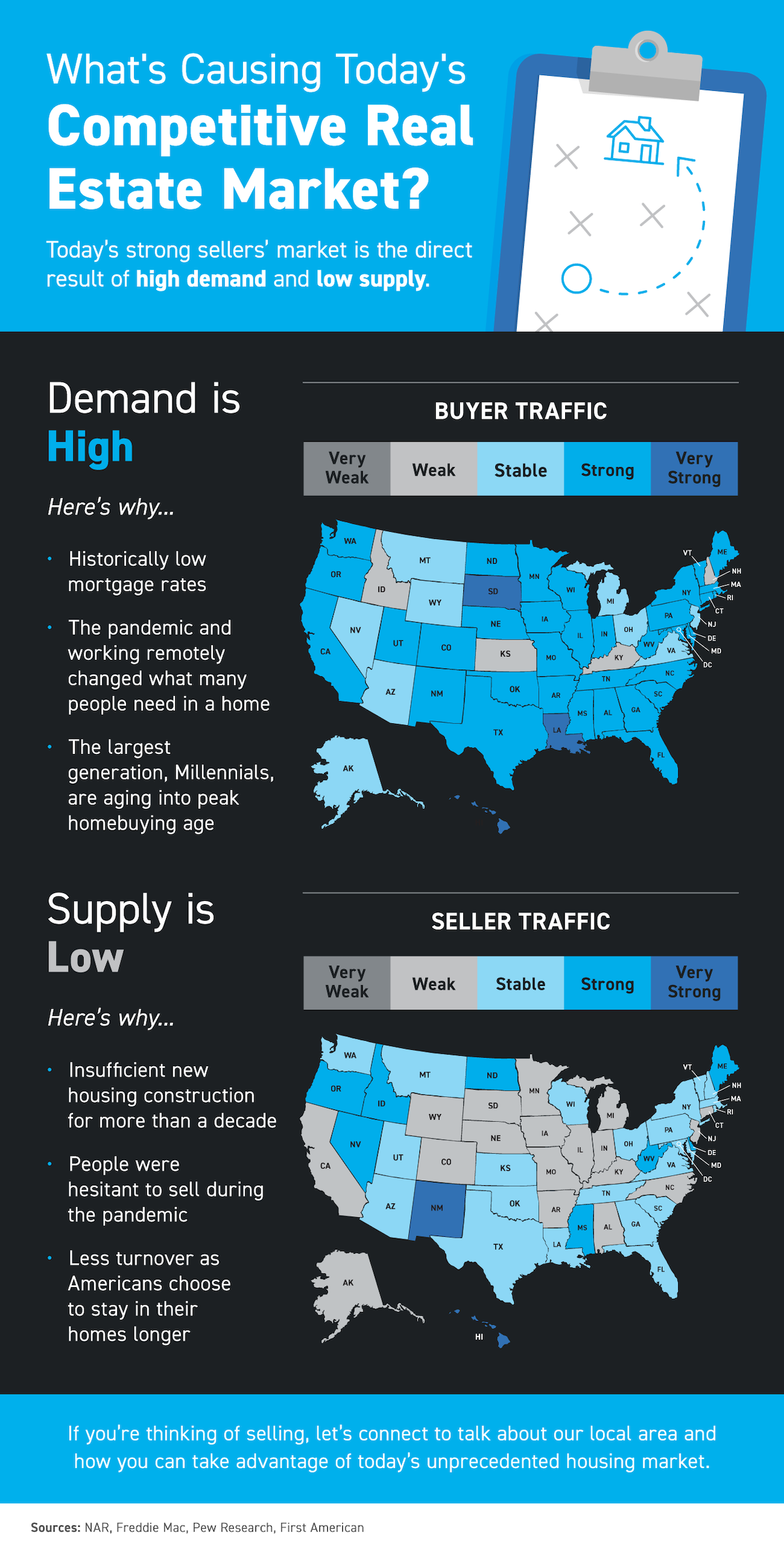

What’s Causing Today’s Competitive Real Estate Market? [INFOGRAPHIC]

Today’s strong sellers’ market is the direct result of high demand and low supply.

Home Price Appreciation Is Skyrocketing in 2021. What About 2022?

One of the major story lines over the last year is how well the residential real estate market performed. One key metric in the spotlight is home price appreciation. According to the latest indices, home prices are skyrocketing this year.

The Community and Economic Impacts of a Home Sale

If you’re thinking of buying or selling a house, chances are you’re focusing on the many extraordinary ways it’ll change your life. What you may not realize is that decision impacts people’s lives far beyond your own. Home purchases and sales are significant drivers of economic activity. They have a major impact on your community and the entire U.S. economy via the multiple industries and professionals that take part in the process.